Budget 2015-2016: Key Features

Sakshi Education

Following are the highlights of the Union Budget 2015-16 presented by Finance Minister Arun Jaitley in Parliament:

- After inheriting an economy with sentiments of “doom and gloom” with adverse macro-economic indicators, nine months have seen at turn around, making India fastest growing large economy in the World with a real GDP growth expected to be 7.4% (New Series).

- Stock market - Second best performing in 2014.

- Macro-economic stability and conditions for sustainable poverty alleviation, job creation and durable double digit economic growth have been achieved.

- Financial Inclusion- 12.5 crores families financially mainstreamed in 100 days.

- Transparent Coal Block auctions to augment resources of the States.

- Swachh Bharat is not only a programme to improve hygiene and cleanliness but has become a movement to regenerate India.

- Goods and Service Tax (GST)

- Jan Dhan, Aadhar and Mobile (JAM) - for direct benefit transfer.

- Inflation declined - a structural shift

- CPI inflation projected at 5% by the end of the year, consequently, easing of monetary policy.

- Monetary Policy Framework Agreement with RBI, to keep inflation below 6%.

- GDP growth in 2015-16, projected to be between 8 to 8.5%.

- Amrut Mahotsav - The year 2022, 75th year of Independence Vision for “Team India” led by PM.

- Housing for all - 2 crore houses in Urban areas and 4 crore houses in Rural areas.

- Basic facility of 24x7 power, clean drinking water, a toilet and road connectivity.

- At least one member has access to means for livelihood.

- Substantial reduction in poverty.

- Electrification of the remaining 20,000 villages including off-grid Solar Power- by 2020.

- Connecting each of the 1,78,000 un-connected habitation.

- Providing medical services in each village and city.

- Ensure a Senior Secondary School within 5 km reach of every child, while improving quality of education and learning outcomes.

- To strengthen rural economy - increase irrigated area, improve the efficiency of existing irrigation systems, and ensure value addition and reasonable price for farm produce.

- Ensure communication connectivity to all villages.

- To make India, the manufacturing hub of the World through Skill India and the Make in India Programmes.

- Encourage and grow the spirit of entrepreneurship - to turn youth into job creators.

- Development of Eastern and North Eastern regions on par with the rest of the country.

- Five major challenges: Agricultural income under stress, increasing investment ininfrastructure, decline in manufacturing, resource crunch in view of higher devolution in taxes to states, maintaining fiscal discipline.

- To meet these challenges public sector needs to step in to catalyse investment, make in india programme to create jobs in manufacturing, continue support to programmes with important national priorities such as agriculture, education, health, MGNREGA, rural infrastructure including roads.

- Challenge of maintaining fiscal deficit of 4.1% of GDP met in 2014-15, despite lower nominal GDP growth due to lower inflation and consequent sub-dued tax buoyancy.

- Government firm on journey to achieve fiscal target of 3% of GDP.

- Realistic figures shown in fiscal account without showing exaggerated revenue projections.

- With improved economy, pressure to accelerate fiscal consolidation too has decreased.

- Accordingly, journey for fiscal deficit target of 3% will be achieved in 3 years rather than 2 years. The fiscal deficit targets are 3.9%, 3.5% and 3.0% in FY 2015-16, 2016-17 & 2017-18 respectively.

- Additional fiscal space will go to funding infrastructure investment.

- Need to view public finances from a National perspective and not just the perspective of the Central Government. Aggregate public expenditure of the Governments, as a whole can be expected to rise substantially.

- Disinvestment to include both disinvestment in loss making units, and some strategic disinvestment.

- Need to cut subsidy leakages, not subsidies themselves. To achieve this, Government committed to the process of rationalizing subsidies.

- Direct Transfer of Benefits to be extended further with a view to increase the number of beneficiaries from 1 crore to 10.3 crore.

- Major steps take to address the two major factors critical to agricultural production, that of soil and water.

- ‘Paramparagat Krishi Vikas Yojana’ to be fully supported.

- ‘Pradhanmantri Gram Sinchai Yojana’ to provide ‘Per Drop More Crop’.

- 5,300 crore to support micro-irrigation, watershed development and the ‘Pradhan Mantri Krishi Sinchai Yojana’. States urged to chip in. 25,000 crore in 2015-16 to the corpus of Rural Infrastructure Development Fund (RIDF) set up in NABARD;

- 15,000 crore for Long Term Rural Credit Fund;

- 45,000 crore for Short Term Co-operative Rural Credit Refinance Fund; and

- 15,000 crore for Short Term RRB Refinance Fund.

- arget of 8.5 lakh crore of agricultural credit during the year 2015-16.

- Focus on improving the quality and effectiveness of activities under MGNREGA.

- Need to create a National Agriculture Market for the benefit farmers, which will also have the incidental, benefit of moderating price rises. Government to work with the States, in NITI, for the creation of a Unified National Agriculture Market.

- Micro Units Development Refinance Agency (MUDRA) Bank, with a corpus of 20,000 crores, and credit guarantee corpus of 3,000 crores to be created.

- In lending, priority will be given to SC/ST enterprises.

- New structure of electronic filing of statements by reporting entities to ensure seamless integration of data for more effective enforcement.

- Bill for a comprehensive new law to deal with black money parked abroad to be introduced in the current session.

- MUDRA Bank will be responsible for refinancing all Micro-finance Institutions which are in the business of lending to such small entities of business through a Pradhan Mantri Mudra Yojana.

- A Trade Receivables discounting System (TReDS) which will be an electronic platform for facilitating financing of trade receivables of MSMEs to be established.

- Comprehensive Bankruptcy Code of global standards to be brought in fiscal 2015-16 towards ease of doing business.

- Postal network with 1,54,000 points of presence spread across villages to be used for increasing access of the people to the formal financial system.

- NBFCs registered with RBI and having asset size of `500 crore and above may be considered for notifications as ‘Financial Institution’ in terms of the SARFAESI Act, 2002.

- Government to work towards creating a functional social security system for all Indians, specially the poor and the under-privileged.

- Pradhan Mantri Suraksha Bima Yojna to cover accidental death risk of `2 Lakh for a premium of just `12 per year.

- Atal Pension Yojana to provide a defined pension, depending on the contribution and the period of contribution. Government to contribute 50% of the beneficiaries’ premium limited to `1,000 each year, for five years, in the new accounts opened before 31st December 2015.

- Pradhan Mantri Jeevan Jyoti Bima Yojana to cover both natural and accidental death risk of `2 lakh at premium of `330 per year for the age group of 18-50.

- A new scheme for providing Physical Aids and Assisted Living Devices for senior citizens, living below the poeverty line.

- Unclaimed deposits of about `3,000 crores in the PPF, and approximately `6,000 crores in the EPF corpus. The amounts to be appropriated to a corpus, which will be used to subsidize the premiums on these social security schemes through creation of a Senior Citizen Welfare Fund in the Finance Bill.

- Government committed to the on-going schemes for welfare of SCs, STs and Women.

- Sharp increase in outlays of roads and railways. Capital expenditure of public sector units to also go up.

- National Investment and Infrastructure Fund (NIIF), to be established with an annual flow of `20,000 crores to it.

- Tax free infrastructure bonds for the projects in the rail, road and irrigation sectors.

- PPP mode of infrastructure development to be revisited and revitalised.

- Atal Innovation Mission (AIM) to be established in NITI to provide Innovation Promotion Platform involving academicians, and drawing upon national and international experiences to foster a culture of innovation , research and development. A sum of Rs. 150 crore will be earmarked.

- Concerns of IT industries for a more liberal system of raising global capital, incubation facilities in our Centres of Excellence, funding for seed capital and growth, and ease of Doing Business etc. would be addressed for creating hundreds of billion dollars in value.

- (SETU) Self-Employment and Talent Utilization) to be established as Techno-financial, incubation and facilitation programme to support all aspects of start-up business. Rs. 1000 crore to be set aside as initial amount in NITI.

- Ports in public sector will be encouraged, to corporatize, and become companies under the Companies Act to attract investment and leverage the huge land resources.

- An expert committee to examine the possibility and prepare a draft legislation where the need for multiple prior permission can be replaced by a pre-existing regulatory mechanism. This will facilitate India becoming an investment destination.

- 5 new Ultra Mega Power Projects, each of 4000 MW, in the Plug-and-Play mode.

- Public Debt Management Agency (PDMA) bringing both external and domestic borrowings under one roof to be set up this year.

- Enabling legislation, amending the Government Securities Act and the RBI Act included in the Finance Bill, 2015.

- Forward Markets commission to be merged with SEBI.

- Section-6 of FEMA to be amended through Finance Bill to provide control on capital flows as equity will be exercised by Government in consultation with RBI.

- Proposal to create a Task Force to establish sector-neutral financial redressal agency that will address grievance against all financial service providers.

- India Financial Code to be introduced soon in Parliament for consideration.

- Vision of putting in place a direct tax regime, which is internationally competitive on rates, without exemptions.

- Government to bring enabling legislation to allow employee to opt for EPF or New Pension Scheme. For employee’s below a certain threshold of monthly income, contribution to EPF to be option, without affecting employees’ contribution.

- Gold monetisation scheme to allow the depositors of gold to earn interest in their metal accounts and the jewellers to obtain loans in their metal account to be introduced.

- Sovereign Gold Bond, as an alternative to purchasing metal gold scheme to be developed.

- Commence work on developing an Indian gold coin, which will carry the Ashok Chakra on its face.

- Foreign investments in Alternate Investment Funds to be allowed.

- Distinction between different types of foreign investments, especially between foreign portfolio investments and foreign direct investments to be done away with. Replacement with composite caps.

- A project development company to facilitate setting up manufacturing hubs in CMLV countries, namely, Cambodia, Myanmar, Laos and Vietnam.

Safe India

Rs. 1000 crores to the Nirbhaya Fund.

Tourism

Rs. 1000 crores to the Nirbhaya Fund.

Tourism

- Resources to be provided to start work along landscape restoration, signage and interpretation centres, parking, access for the differently abled , visitors’ amenities, including securities and toilets, illumination and plans for benefiting communities around them at various heritage sites.

- Visas on arrival to be increased to 150 countries in stages.

- Target of renewable energy capacity revised to 175000 MW till 2022, comprising 100000 MW Solar, 60000 MW Wind, 10000 MW Biomass and 5000 MW Small Hydro.

- A need for procurement law to contain malfeasance in public procurement.

- Proposal to introduce a public Contracts (resolution of disputes) Bill to streamline the institutional arrangements for resolution of such disputes.

- Proposal to introduce a regulatory reform Bill that will bring about a cogency of approach across various sectors of infrastructure.

- Less than 5% of our potential work force gets formal skill training to be employable. A national skill mission to consolidate skill initiatives spread accross several ministries to be launched.

- Deen Dayal Upadhyay Gramin Kaushal Yojana to enhance the employability of rural youth.

- A Committee for 100th birth celebration of Shri Deen Dayalji Upadhyay to be announced soon.

- A student Financial Aid Authority to administer and monitor the front-end all scholarship as well Educational Loan Schemes, through the Pradhan Mantri Vidya Lakshmi Karyakram.

- An IIT to be set up in Karnataka and Indian School of Mines, Dhanbad to be upgraded in to a full-fledged IIT.

- New All India Institute of Medical Science (AIIMS) to be set up in J&K Punjab, Tamil Nadu, Himachal Pradesh and Assam. Another AIIMS like institutions to be set up in Bihar.

- A post graduate institute of Horticulture Research & Education is to be set up in Amritsar.

- 3 new National Institute of Pharmaceuticals Education and Research in Maharashtra, Rajasthan and Chattisgarh and one institute of Science and Education Research is to be set up in Nagaland & Orissa each.

- An autonomous Bank Board Bureau to be set up to improve the governance of public sector bank.

- The National Optical Fibre Network Programme (NOFNP) to be further speeded up by allowing willing states to execute on reimbursement of cost basis.

- Special assistance to Bihar & West Bengal to be provided as in the case of Andhra Pradesh.

- Government is committed to comply with all the legal commitments made to AP & Telengana at the time of their re-organisation.

- In spite of large increase in devolution to state sufficient fund allocated to education, health, rural development, housing, urban development, women and child development, water resources & cleaning of Ganga.

- Part of Delhi-Mumbai Industrial Corridor (DMIC); Ahmedabad-Dhaulera Investment region and Shendra-Bidkin Industrial Park are now in a position to start work on basic infrastructure.

- Made in India and the Buy and the make in India policy are being carefully pursued to achieve greater self-sufficiency in the area of defence equipment including air-craft.

- The first phase of GIFT to become a reality very soon. Appropriate regulations to be issued in March.

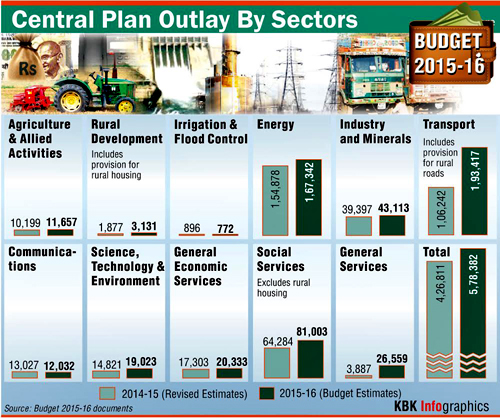

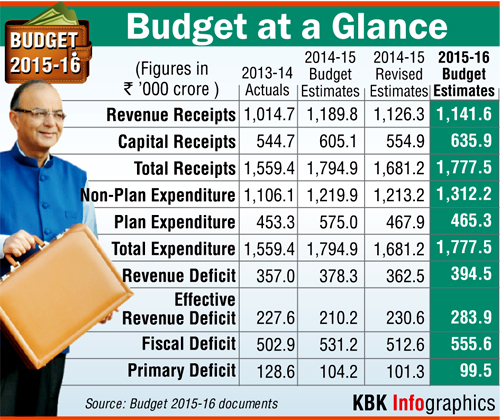

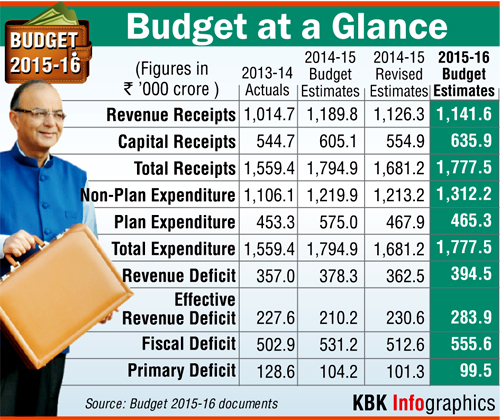

- Non-Plan expenditure estimates for the Financial Year are estimated at Rs. 13,12,200 crore.

- Plan expenditure is estimated to be Rs. 4,65,277 crore, which is very near to the R.E. of 2014-15.

- Total Expenditure has accordingly been estimated at Rs. 17,77,477 crore.

- The requirements for expenditure on Defence, Internal Security and other necessary expenditures are adequately provided.

- Gross Tax receipts are estimated to be Rs. 14,49,490 crore.

- Devolution to the States is estimated to be Rs. 5,23,958.

- Share of Central Government will be Rs. 9,19,842.

- Non Tax Revenues for the next fiscal are estimated to be Rs. 2,21,733 crore.

- Fiscal deficit will be 3.9 per cent of GDP and Revenue Deficit will be 2.8 per cent of GDP.

- Objective of stable taxation policy and a non-adversarial tax administration.

- Fight against the scourge of black money to be taken forward.

- Efforts on various fronts to implement GST from next year.

- No change in rate of personal income tax.

- Proposal to reduce corporate tax from 30% to 25% over the next four years, starting from next financial year.

- Rationalisation and removal of various tax exemptions and incentives to reduce tax disputes and improve administration.

- Exemption to individual tax payers to continue to facilitate savings.

- Generation of black money and its concealment to be dealt with effectively and forcefully.

- Investigation into cases of undisclosed foreign assets has been given highest priority in the last nine months.

- Major breakthrough with Swiss authorities, who have agreed to:

- Provide information in respect of cases independently investigated by IT department;

- Confirm genuineness of bank accounts and provide non-banking information;

- Provide such information in time-bound manner; and Commence talks for automatic exchange of information.

- New structure of electronic filing of statements by reporting entities to ensure seamless integration of data for more effective enforcement.

- Bill for a comprehensive new law to deal with black money parked abroad to be introduced in the current session.

- Evasion of tax in relation to foreign assets to have a punishment of rigorous imprisonment upto 10 years, be non-compoundable, have a penalty rate of 300% and the offender will not be permitted to approach the Settlement Commission.

- Non-filing of return/filing of return with inadequate disclosures to have a punishment of rigorous imprisonment upto 7 years.

- Undisclosed income from any foreign assets to be taxable at the maximum marginal rate.

- Mandatory filing of return in respect of foreign asset.

- Entities, banks, financial institutions including individuals all liable for prosecution and penalty.

- Concealment of income/evasion of income in relation to a foreign asset to be made a predicate offence under PML Act, 2002.

- PML Act, 2002 and FEMA to be amended to enable administration of new Act on black money.

- Benami Transactions (Prohibition) Bill to curb domestic black money to be introduced in the current session of Parliament.

- Acceptance or re-payment of an advance of 20,000 or more in cash for purchase of immovable property to be prohibited.

- PAN being made mandatory for any purchase or sale exceeding Rupees 1 lakh.

- Third party reporting entities would be required to furnish information about foreign currency sales and cross border transactions.

- Provision to tackle splitting of reportable transactions.

- Leverage of technology by CBDT and CBEC to access information from either’s data bases.

- Revival of growth and investment and promotion of domestic manufacturing for job creation.

- Tax “pass through” to be allowed to both category I and category II alternative investment funds.

- Rationalisation of capital gains regime for the sponsors exiting at the time of listing of the units of REITs and InvITs.

- Rental income of REITs from their own assets to have pass through facility.

- Permanent Establishment (PE) norm to be modified to encourage fund managers to relocate to India.

- General Anti Avoidance Rule (GAAR) to be deferred by two years.

- GAAR to apply to investments made on or after 01.04.2017, when implemented.

- Additional investment allowance (@15%) and additional depreciation (@35%) to new manufacturing units set up during the period 01-04-2015 to 31-03-2020 in notified backward areas of Andhra Pradesh and Telangana.

- Rate of Income-tax on royalty and fees for technical services reduced from 25% to 10% to facilitate technology inflow.

- Benefit of deduction for employment of new regular workmen to all business entities and eligibility threshold reduced.

- Basic Custom duty on certain inputs, raw materials, inter mediates and components in 22 items, reduced to minimise the impact of duty inversion.

- All goods, except populated printed circuit boards for use in manufacture of ITA bound items, exempted from SAD.

- SAD reduced on import of certain inputs and raw materials.

- Excise duty on chassis for ambulance reduced from 24% to 12.5%.

- Balance of 50% of additional depreciation @ 20% for new plant and machinery installed and used for less than six months by a manufacturing unit or a unit engaged in generation and distribution of power is to be allowed immediately in the next year.

- Simplification of tax procedures.

- Monetary limit for a case to be heard by a single member bench of ITAT increase from 5 lakh to15 lakh.

- Penalty provision in indirect taxes are being rationalised to encourage compliance and early dispute resolution.

- Central excise/Service tax assesses to be allowed to use digitally signed invoices and maintain record electronically.

- Wealth-tax replaced with additional surcharge of 2 per cent on super rich with a taxable income of over 1 crore annually.

- Provision of indirect transfers in the Income-tax Act suitably cleaned up.

- Applicability of indirect transfer provisions to dividends paid by foreign companies to their shareholders to be addressed through a clarificatory circular.

- Domestic transfer pricing threshold limit increased from 5 crore to 20 crore.

- MAT rationalised for FIIs and members of an AOP.

- Tax Administration Reform Commission (TARC) recommendations to be appropriately implemented during the course of the year.

- Education cess and the Secondary and Higher education cess to be subsumed in Central Excise Duty.

- Specific rates of central excise duty in case of certain other commodities revised.

- Excise levy on cigarettes and the compounded levy scheme applicable to pan masala, gutkha and other tobacco products also changed.

- Excise duty on footwear with leather uppers and having retail price of more than 1000 per pair reduced to 6%.

- Online central excise and service tax registration to be done in two working days.

- Time limit for taking CENVAT credit on inputs and input services increased from 6 months to 1 year.

- Service-tax plus education cesses increased from 12.36% to 14% to facilitate transition to GST.

- Donation made to National Fund for Control of Drug Abuse (NFCDA) to be eligible for 100% deduction u/s 80G of Income-tax Act.

- Seized cash can be adjusted towards assesses tax liability.

- 100% deduction for contributions, other than by way of CSR contribution, to Swachh Bharat Kosh and Clean Ganga Fund.

- Clean energy cess increased from 100 to 200 per metric tonne of coal, etc. to finance clean environment initiatives.

- Excise duty on sacks and bags of polymers of ethylene other than for industrial use increased from 12% to 15%.

- Enabling provision to levy Swachh Bharat cess at a rate of 2% or less on all or certain services, if need arises.

- Services by common affluent treatment plant exempt from Service-tax.

- Concessions on custom and excise duty available to electrically operated vehicles and hybrid vehicles extended upto 31.03.2016.

- Limit of deduction of health insurance premium increased from 15000 to 25000, for senior citizens limit increased from 20000 to 30000.

- Senior citizens above the age of 80 years, who are not covered by health insurance, to be allowed deduction of 30000 towards medical expenditures.

- Deduction limit of 60000 with respect to specified decease of serious nature enhanced to 80000 in case of senior citizen.

- Additional deduction of 25000 allowed for differently abled persons.

- Limit on deduction on account of contribution to a pension fund and the new pension scheme increased from 1 lakh to 1.5 lakh.

- Additional deduction of 50000 for contribution to the new pension scheme u/s 80CCD.

- Payments to the beneficiaries including interest payment on deposit in Sukanya Samriddhi scheme to be fully exempt.

- Service-tax exemption on Varishtha Bima Yojana.

- Concession to individual tax-payers despite inadequate fiscal space.

- Lot to look forward to as fiscal capacity improves.

- Conversion of existing excise duty on petrol and diesel to the extent of 4 per litre into Road Cess to fund investment.

- Service Tax exemption extended to certain pre cold storage services in relation to fruits and vegetables so as to incentivise value addition in crucial sector.

- Negative List under service-tax is being slightly pruned to widen the tax base.

- Yoga to be included within the ambit of charitable purpose under Section 2(15) of the Income-tax Act.

- To mitigate the problem being faced by many genuine charitable institutions, it is proposed to modify the ceiling on receipts from activities in the nature of trade, commerce or business to 20% of the total receipts from the existing ceiling of 25 lakh.

- Most provisions of Direct Taxes Code have already been included in the Income-tax Act; therefore, no great merit in going ahead with the Direct Taxes Code as it exists today.

- Direct tax proposals to result in revenue loss of 8315 crore, whereas the proposals in indirect taxes are expected to yield 23383 crore. Thus, the net impact of all tax proposals would be revenue gain of 15068 crore.

- Increase in basic custom duty.

- Metallergical coke from 2.5 % to 5%.

- Tariff rate on iron and steel and articles of iron and steel increased from 10% to 15%.

- Tariff rate on commercial vehicle increased from 10 % to 40%.

- Basic custom duty on digital still image video camera with certain specification reduced to nil.

- Excise duty on rails for manufacture of railway or tram way track construction material exempted retrospectively from 17-03-2012 to 02-02-2014, if not CENVAT credit of duty paid on such rails is availed.

- Service-tax to be levied on service provided by way of access to amusement facility, entertainment events or concerts, pageants, non recoganised sporting events etc.

- Enabling provision made to exclude all services provided by the Government or local authority to a business entity from the negative list.

- Service-tax exemption to construction, erection, commissioning or installation of original works pertaining to an airport or port withdrawn.

- Transportation of agricultural produce to remain exempt from Service-tax.

- Artificial heart exempt from basic custom duty of 5% and CVD.

- Excise duty exemption for captively consumed intermediate compound coming into existance during the manufacture of Agarbathi.

- Services of pre-conditioning, pre-cooling, ripening etc. of fruits and vegetables.

- Life insurance service provided by way of Varishtha Pension Bima Yojana.

- All ambulance services provided to patients.

- Admission to museum, zoo, national park, wild life sanctuary and tiger reserve.

- Transport of goods for export by road from factory to land customs station.

Published date : 16 Mar 2015 10:38AM