Unit VII: Introduction to Financial Accounting

Sakshi Education

Definition of Accounting:

The systematic and comprehensive recording of financial transactions pertaining to a business is called accounting. Accounting also refers to the process of summarizing, analyzing and reporting these transactions. The financial statements that summarize a large company's operations, financial position and cash flows over a particular period are a concise summary of hundreds of thousands of financial transactions it may have entered into over this period. Accounting is one of the key functions for almost any business; it may be handled by a bookkeeper and accountant at small firms or by sizable finance.

Double entry system (Departments with dozens of employees at larger companies): The double entry system of accounting or bookkeeping means that every business transaction will involve two accounts (or more). For example, when a company borrows money from its bank, the company's Cash account will increase and its liability account Loans Payable will increase. If a company pays RS.200 for an advertisement, its Cash account will decrease and its account Advertising Expense will increase.

Double entry also allows for the accounting equation (assets = liabilities + owner's equity) to always be in balance. In our example involving Advertising Expense, the accounting equation remained in balance because expenses cause owner's equity to decrease. In that example, the asset Cash decreased and the owner's capital account within owner's equity also decreased.

A third aspect of double entry is that the amounts entered into the general ledger accounts as debits must be equal to the amounts entered as credits.

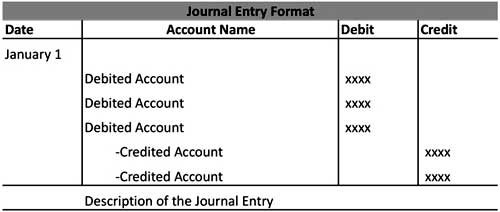

Definition of Journal:

In accounting, a first recording of financial transactions as they occur in time, so that they can then be used for future reconciling and transfer to other official accounting records such as the general ledger. A journal will state the date of the transaction, which account(s) were affected and the amounts, usually in a double-entry bookkeeping method.

For an individual investor or professional manager, a detailed record of trades occurring in the investor's own accounts, used for tax, evaluation and auditing purposes.

In accounting and bookkeeping, a journal is a record of financial transactions in order by date. A journal is often defined as the book of original entry. The definition was more appropriate when transactions were written in a journal prior to manually posting them to the accounts in the general ledger or subsidiary ledger. Manual systems usually had a variety of journals such as a sales journal, purchases journal, cash receipts journal, cash disbursements journal, and a general journal.

With today's computerized bookkeeping and accounting, it is likely to find only a general journal in which adjusting entries and unique financial transactions are entered. The recording and posting of most transactions will occur automatically when sales and vendor invoice information is entered, checks are written, etc. In other words, accounting software has eliminated the need to first record routine transactions into a journal.

Ledger and Ledger Accounts:

The final destination of all entries made in the journal is the ledger as they are all subsequently transferred to it. The ledger is the most important book under the double-entry system. Ledger is a permanent book of record, which contains all accounts relating to the financial transactions of a business. Therefore, it is also called the book of accounts. An account contained in the ledger book is called ledger account.

A ledger account is a statement shaped liked an English alphabet 'T' that systematically contains all financial transactions relating to either a particular person or thing for a certain period of time. Ledger account provides financial information such as how much a particular person owes to or from the business, what is the value of particular asset the business possesses at a point in time, or what is the amount of particular head of expense or income business has incurred or earned during a particular period.

The ledger book, therefore, contains the details of all classified information of financial transactions of the business. It is also called the principal or main book of accounts. It collects records and provides the financial information of the business in a classified manner so as to ascertain the profit and loss and financial position of the business at a certain point of time.

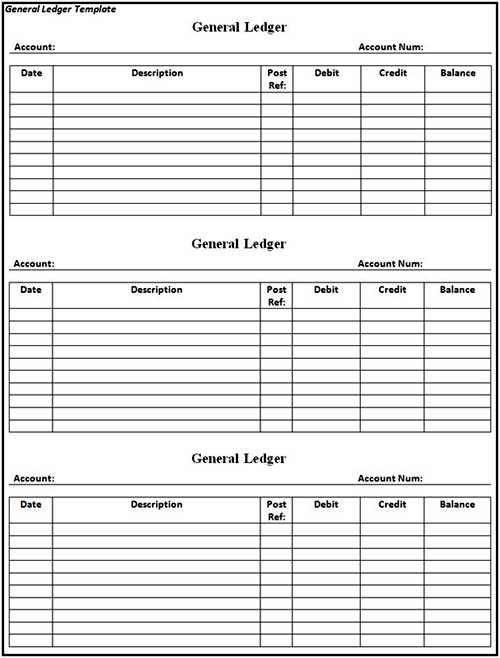

General Ledger:

Every business has a variety of expenses and ways of earning income, just as you have different bills and different income streams. Like you, a business may have utility bills, rent expenses, and vehicle repair costs, while its income may come different places, such as sales, interest from bank accounts, loans, or from selling items that the company owns. You might record these events as they occur in your life in your check register.

For a business, all of these financial events, or transactions, must be recorded in their financial books. The general ledger is a company's master account book, with all of the various accounts in one place. The general ledger is used in conjunction with a couple of other accounting tools, which we will see below.

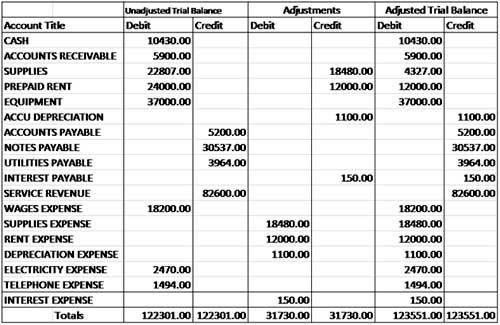

Trial Balance:

A book keeping worksheet in which the balances of all ledgers are compiled into debit and credit columns. A company prepares a trial balance periodically, usually at the end of every reporting period. The general purpose of producing a trial balance is to ensure the entries in a company's bookkeeping system are mathematically correct.

Definition of trial balance:

A book keeping worksheet in which the balances of all ledgers are compiled into debit and credit columns. A company prepares a trial balance periodically, usually at the end of every reporting period. The general purpose of producing a trial balance is to ensure the entries in a company's bookkeeping system are mathematically correct.

Trial balance:

Preparing a trial balance for a company serves to detect any mathematical errors that have occurred in the double-entry accounting system. Provided the total debts equal the total credits, the trial balance is considered to be balanced, and there should be no mathematical errors in the ledgers.

However, this does not mean there are no errors in a company's accounting system. For example, transactions classified improperly or those simply missing from the system could still be material accounting errors that would not be detected by the trial balance procedure.

Financial Statements:

Trading account:

Trading refers buying and selling of goods. Trading A/c shows the result of buying and selling of goods. This account is prepared to find out the difference between the Selling prices and Cost price. If the selling price exceeds the cost price, it will bring Gross Profit. For example, if the cost price of Rs. 50,000 worth of goods are sold for Rs. 60,000 that will bring in Gross Profit of Rs. 10,000. If the cost price exceeds the selling price, the result will be Gross Loss. For example, if the cost price Rs. 60,000 worth of goods are sold for Rs. 50,000 that will result in Gross Loss of Rs. 10,000. Thus the Gross Profit or Gross Loss is indicated in Trading Account. Items appearing in the Debit side of Trading Account.

Opening Stock:

Stock on hand at the commencement of the year or period is termed as the Opening Stock.

Purchases:

It indicates total purchases both cash and credit made during the year. Purchases Returns or Returns out words: Purchases Returns must be subtracted from the total purchases to get the net purchases. Net purchases will be shown in the trading account.

Direct Expenses on Purchases: Some of the Direct Expenses are.

a) Wages:

It is also known as Productive wages or Manufacturing wages. Carriage or Carriage Inwards:

b) Octroi Duty:

Duty paid on goods for bringing them within municipal limits. Customs duty, dock dues, clearing charges, Import duty etc. Fuel, Power, Lighting charges related to production.oil, Grease and Waste.

c) Packing charges:

Such expenses are incurred with a view to put the goods in the Saleable Condition. Items appearing on the credit side of Trading Account

d) Sales:

Total Sales (Including both cash and credit) made during the year.

e) Sales Returns or Return Inwards:

Sales Returns must be subtracted from the Total Sales to get Net sales. Net Sales will be shown.

f) Closing stock:

Generally, Closing stock does not appear in the Trial Balance. It appears outside the Trial balance. It represents the value of goods at the end of the trading period represent a formal record of the financial activities of an entity. These are written reports that quantify the financial strength, performance and liquidity of a company. Financial Statements reflect the financial effects of business transactions and events on the entity.

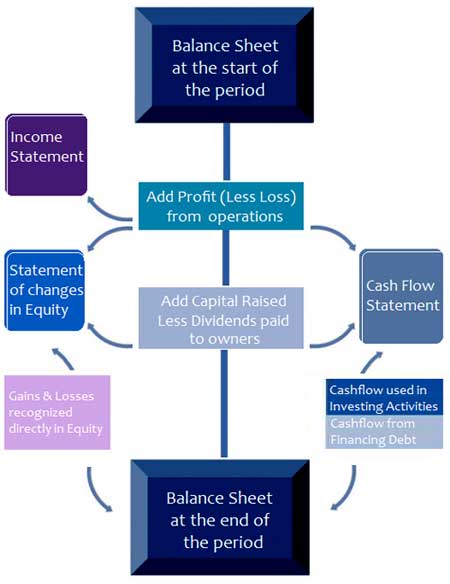

Four Types of Financial Statements:

Statement of Financial Position

Statement of Financial Position, also known as the Balance Sheet, presents the financial position of an entity at a given date. It is comprised of the following three elements:

Assets:

Something a business owns or controls (e.g. cash, inventory, plant and machinery, etc)

Liabilities:

Something a business owes to someone (e.g. creditors, bank loans, etc)

Equity:

What the business owes to its owners. This represents the amount of capital that remains in the business after its assets are used to pay off its outstanding liabilities. Equity therefore represents the difference between the assets and liabilities.

Income Statement:

Income Statement, also known as the Profit and Loss Statement, reports the company's financial performance in terms of net profit or loss over a specified period. Income Statement is composed of the following two elements:

Income: What the business has earned over a period (e.g. sales revenue, dividend income, etc)

Expense: The cost incurred by the business over a period (e.g. salaries and wages, depreciation, rental charges, etc). Net profit or loss is arrived by deducting expenses from income.

Cash Flow Statement:

Cash Flow Statement, presents the movement in cash and bank balances over a period. The movement in cash flows is classified into the following segments:

Operating Activities:

Represents the cash flow from primary activities of a business.

Investing Activities:

Represents cash flow from the purchase and sale of assets other than inventories (e.g. purchase of a factory plant)

Financing Activities:

Represents cash flow generated or spent on raising and repaying share capital and debt together with the payments of interest and dividends.

The systematic and comprehensive recording of financial transactions pertaining to a business is called accounting. Accounting also refers to the process of summarizing, analyzing and reporting these transactions. The financial statements that summarize a large company's operations, financial position and cash flows over a particular period are a concise summary of hundreds of thousands of financial transactions it may have entered into over this period. Accounting is one of the key functions for almost any business; it may be handled by a bookkeeper and accountant at small firms or by sizable finance.

Double entry system (Departments with dozens of employees at larger companies): The double entry system of accounting or bookkeeping means that every business transaction will involve two accounts (or more). For example, when a company borrows money from its bank, the company's Cash account will increase and its liability account Loans Payable will increase. If a company pays RS.200 for an advertisement, its Cash account will decrease and its account Advertising Expense will increase.

Double entry also allows for the accounting equation (assets = liabilities + owner's equity) to always be in balance. In our example involving Advertising Expense, the accounting equation remained in balance because expenses cause owner's equity to decrease. In that example, the asset Cash decreased and the owner's capital account within owner's equity also decreased.

A third aspect of double entry is that the amounts entered into the general ledger accounts as debits must be equal to the amounts entered as credits.

Definition of Journal:

In accounting, a first recording of financial transactions as they occur in time, so that they can then be used for future reconciling and transfer to other official accounting records such as the general ledger. A journal will state the date of the transaction, which account(s) were affected and the amounts, usually in a double-entry bookkeeping method.

For an individual investor or professional manager, a detailed record of trades occurring in the investor's own accounts, used for tax, evaluation and auditing purposes.

In accounting and bookkeeping, a journal is a record of financial transactions in order by date. A journal is often defined as the book of original entry. The definition was more appropriate when transactions were written in a journal prior to manually posting them to the accounts in the general ledger or subsidiary ledger. Manual systems usually had a variety of journals such as a sales journal, purchases journal, cash receipts journal, cash disbursements journal, and a general journal.

With today's computerized bookkeeping and accounting, it is likely to find only a general journal in which adjusting entries and unique financial transactions are entered. The recording and posting of most transactions will occur automatically when sales and vendor invoice information is entered, checks are written, etc. In other words, accounting software has eliminated the need to first record routine transactions into a journal.

Ledger and Ledger Accounts:

The final destination of all entries made in the journal is the ledger as they are all subsequently transferred to it. The ledger is the most important book under the double-entry system. Ledger is a permanent book of record, which contains all accounts relating to the financial transactions of a business. Therefore, it is also called the book of accounts. An account contained in the ledger book is called ledger account.

A ledger account is a statement shaped liked an English alphabet 'T' that systematically contains all financial transactions relating to either a particular person or thing for a certain period of time. Ledger account provides financial information such as how much a particular person owes to or from the business, what is the value of particular asset the business possesses at a point in time, or what is the amount of particular head of expense or income business has incurred or earned during a particular period.

The ledger book, therefore, contains the details of all classified information of financial transactions of the business. It is also called the principal or main book of accounts. It collects records and provides the financial information of the business in a classified manner so as to ascertain the profit and loss and financial position of the business at a certain point of time.

General Ledger:

Every business has a variety of expenses and ways of earning income, just as you have different bills and different income streams. Like you, a business may have utility bills, rent expenses, and vehicle repair costs, while its income may come different places, such as sales, interest from bank accounts, loans, or from selling items that the company owns. You might record these events as they occur in your life in your check register.

For a business, all of these financial events, or transactions, must be recorded in their financial books. The general ledger is a company's master account book, with all of the various accounts in one place. The general ledger is used in conjunction with a couple of other accounting tools, which we will see below.

Trial Balance:

A book keeping worksheet in which the balances of all ledgers are compiled into debit and credit columns. A company prepares a trial balance periodically, usually at the end of every reporting period. The general purpose of producing a trial balance is to ensure the entries in a company's bookkeeping system are mathematically correct.

Definition of trial balance:

A book keeping worksheet in which the balances of all ledgers are compiled into debit and credit columns. A company prepares a trial balance periodically, usually at the end of every reporting period. The general purpose of producing a trial balance is to ensure the entries in a company's bookkeeping system are mathematically correct.

Trial balance:

Preparing a trial balance for a company serves to detect any mathematical errors that have occurred in the double-entry accounting system. Provided the total debts equal the total credits, the trial balance is considered to be balanced, and there should be no mathematical errors in the ledgers.

However, this does not mean there are no errors in a company's accounting system. For example, transactions classified improperly or those simply missing from the system could still be material accounting errors that would not be detected by the trial balance procedure.

Financial Statements:

Trading account:

Trading refers buying and selling of goods. Trading A/c shows the result of buying and selling of goods. This account is prepared to find out the difference between the Selling prices and Cost price. If the selling price exceeds the cost price, it will bring Gross Profit. For example, if the cost price of Rs. 50,000 worth of goods are sold for Rs. 60,000 that will bring in Gross Profit of Rs. 10,000. If the cost price exceeds the selling price, the result will be Gross Loss. For example, if the cost price Rs. 60,000 worth of goods are sold for Rs. 50,000 that will result in Gross Loss of Rs. 10,000. Thus the Gross Profit or Gross Loss is indicated in Trading Account. Items appearing in the Debit side of Trading Account.

Opening Stock:

Stock on hand at the commencement of the year or period is termed as the Opening Stock.

Purchases:

It indicates total purchases both cash and credit made during the year. Purchases Returns or Returns out words: Purchases Returns must be subtracted from the total purchases to get the net purchases. Net purchases will be shown in the trading account.

Direct Expenses on Purchases: Some of the Direct Expenses are.

a) Wages:

It is also known as Productive wages or Manufacturing wages. Carriage or Carriage Inwards:

b) Octroi Duty:

Duty paid on goods for bringing them within municipal limits. Customs duty, dock dues, clearing charges, Import duty etc. Fuel, Power, Lighting charges related to production.oil, Grease and Waste.

c) Packing charges:

Such expenses are incurred with a view to put the goods in the Saleable Condition. Items appearing on the credit side of Trading Account

d) Sales:

Total Sales (Including both cash and credit) made during the year.

e) Sales Returns or Return Inwards:

Sales Returns must be subtracted from the Total Sales to get Net sales. Net Sales will be shown.

f) Closing stock:

Generally, Closing stock does not appear in the Trial Balance. It appears outside the Trial balance. It represents the value of goods at the end of the trading period represent a formal record of the financial activities of an entity. These are written reports that quantify the financial strength, performance and liquidity of a company. Financial Statements reflect the financial effects of business transactions and events on the entity.

Four Types of Financial Statements:

Statement of Financial Position

Statement of Financial Position, also known as the Balance Sheet, presents the financial position of an entity at a given date. It is comprised of the following three elements:

Assets:

Something a business owns or controls (e.g. cash, inventory, plant and machinery, etc)

Liabilities:

Something a business owes to someone (e.g. creditors, bank loans, etc)

Equity:

What the business owes to its owners. This represents the amount of capital that remains in the business after its assets are used to pay off its outstanding liabilities. Equity therefore represents the difference between the assets and liabilities.

Income Statement:

Income Statement, also known as the Profit and Loss Statement, reports the company's financial performance in terms of net profit or loss over a specified period. Income Statement is composed of the following two elements:

Income: What the business has earned over a period (e.g. sales revenue, dividend income, etc)

Expense: The cost incurred by the business over a period (e.g. salaries and wages, depreciation, rental charges, etc). Net profit or loss is arrived by deducting expenses from income.

Cash Flow Statement:

Cash Flow Statement, presents the movement in cash and bank balances over a period. The movement in cash flows is classified into the following segments:

Operating Activities:

Represents the cash flow from primary activities of a business.

Investing Activities:

Represents cash flow from the purchase and sale of assets other than inventories (e.g. purchase of a factory plant)

Financing Activities:

Represents cash flow generated or spent on raising and repaying share capital and debt together with the payments of interest and dividends.

Published date : 10 Sep 2015 12:48PM