Unit - VI: Capital and Capital Budgeting

Sakshi Education

Capital and its significance:

The concept of cost of capital is a very important concept in financial management decision making. The concept is however, a recent development and has relevance in almost every financial decision making but prior to that development, the problem was ignored or by-passed.

The progressive management always takes notice of the cost of capital while taking a financial decision. The concept is quite relevant in the following managerial decisions.

Capital Budgeting Decision:

Cost of capital may be used as the measuring road for adopting an investment proposal. The firm, naturally, will choose the project which gives a satisfactory return on investment which would in no case be less than the cost of capital incurred for its financing. In various methods of capital budgeting, cost of capital is the key factor in deciding the project out of various proposals pending before the management. It measures the financial performance and determines the acceptability of all investment opportunities.

Indirect Forecast of Sales:

The investment in fixed assets is related to future sales of the firm during the life time of the assets purchased. It shows the possibility of expanding the production facilities to cover additional sales shown in the sales budget. Any failure to make the sales forecast accurately would result in over investment or under investment in fixed assets and any erroneous forecast of asset needs may lead the firm to serious economic results.

Comparative Study of Alternative Projects:

Capital budgeting makes a comparative study of the alternative projects for the replacement of assets which are wearing out or are in danger of becoming obsolete so as to make the best possible investment in the replacement of assets. For this purpose, the profitability of each project is estimated.

Timing of Assets-Acquisition:

Proper capital budgeting leads to proper timing of assets-acquisition and improvement in quality of assets purchased. It is due to ht nature of demand and supply of capital goods. The demand of capital goods does not arise until sales impinge on productive capacity and such situation occurs only intermittently. On the other hand, supply of capital goods with their availability is one of the functions of capital budgeting.

Cash Forecast:

Capital investment requires substantial funds which can only be arranged by making determined efforts to ensure their availability at the right time. Thus, it facilitates cash forecast.

Worth-Maximization of Shareholders:

The impact of long-term capital investment decisions is far reaching. It protects the interests of the shareholders and of the enterprise because it avoids over-investment and under-investment in fixed assets. By selecting the most profitable projects, the management facilitates the wealth maximization of equity share-holders.

Other Factors:

The following other factors can also be considered for its significance:-

It assists in formulating a sound depreciation and assets replacement policy.

It may be useful n considering methods of coast reduction. A reduction campaign may necessitate the consideration of purchasing most up-to-date and modern equipment.

The feasibility of replacing manual work by machinery may be seen from the capital forecast be comparing the manual cost and the capital cost.

The capital cost of improving working conditions or safety can be obtained through capital expenditure forecasting.

It facilitates the management in making of the long-term plans and assists in the formulation of general policy.

It studies the impact of capital investment on the revenue expenditure of the firm such as depreciation, insure and their fixed assets.

Types of Capital, Estimation of Fixed and Working capital requirements:

Meaning of Working capital:

Gross working capital:

When we say working capital, we are referring to the net working capital. Firm’s investment in current assets is called.

Net working capital:

The different between current assets and current liabilities is called Net working capital can be positive or negative. When current assets are in excess of current liabilities, net working capital is positive. On the other hand, when current liabilities exceed current assets, net working capital is negative.

Gross working capital indicates firm’s investment and financing of current assets. Net working capital, on the other hand, shows the liquidity of a firm. As the result, net working capital indicates the financing needs of a firm, both through long-term and short-term financing sources:

Working capital is the part of firm’s capital that is used for routine day-to-day business operations. In other words, working capital refers to the funds needed by the business to run its operations for one accounting year. Working capital reflects the amount of money a firm has at its immediate disposal. For more information about working capital refer to tutorial Liquidity and working capital analysis.

Adequate working capital is important for any business operations. Working capital financing, however, can be a challenge for a business, especially for a small firm. In order to understand the best way to finance working capital, it is important to understand the difference between the two types of working capital:

2. Permanent working capital

- Working Capital refers to that part of the firm’s Capital, which is required for Financing Short-Term or Current Assets such as Cash, Marketable Securities, Debtors and Inventories.

When we say working capital, we are referring to the net working capital. Firm’s investment in current assets is called gross working capital. The different between current assets and current liabilities is called net working capital. Net working capital can be positive or negative. When current assets are in excess of current liabilities, net working capital is positive. On the other hand, when current liabilities exceed current assets, net working capital is negative.

Gross working capital indicates firm’s investment and financing of current assets. Net working capital, on the other hand, shows the liquidity of a firm. As the result, net working capital indicates the financing needs of a firm, both through long-term and short-term financing sources.

Working capital is the part of firm’s capital that is used for routine day-to-day business operations. In other words, working capital refers to the funds needed by the business to run its operations for one accounting year. Working capital reflects the amount of money a firm has at its immediate disposal. For more information about working capital refer to tutorial Liquidity and working capital analysis.

Adequate working capital is important for any business operations. Working capital financing, however, can be a challenge for a business, especially for a small firm. In order to understand the best way to finance working capital, it is important to understand the difference between the two types of working capital:

Essentially, permanent working capital is the minimum level of working capital required for a firm to operate.

Permanent working capital is also called fixed working capital. Permanent working capital does not depend on the level of production or sales. It is similar – in some sense – to fixed assets because of its permanent (fixed) nature. Important to note, however, that permanent working capital is not literally fixed: its level can change over time. The level of permanent working capital depends on the business cycle as well as the growth of a firm.

Permanent working capital can be further divided into the following categories:

It is, therefore, necessary for a new concern to estimate its requirements of funds properly. The financial requirements of a new company may be outlined under the following heads:

Methods and sources of raising finance:

The methods of financing should be adjusted to the stage or phase of the trade cycle. The total capital shall be raised by different means, or what is sometimes called “geared”, according to the phase of the cycle.

Different types of securities may be issued in certain proportions, and what ratio each type will bear to the total capital will depend upon the particular phase.

For example, in the beginning of an optimistic expansion, debentures may be offered to good advantage. At a later time, when speculative enthusiasm is strong, shares will yield better returns. During depression short time borrowing can be resorted to, if the credit of the company is good. The financing plan may be adjusted to the conditions of the market and the security market by varying the proportion, rate of yield, term denominations and guaranteed rights of the securities issued.

The sources of finance for an enterprise can be many and diverse. In the case of individualistic concerns, the chief source of finance is the individual proprietor or proprietors as in a partnership or a Joint Hindu family business. This may be supplemented by borrowed money in varying amounts according as the credit of the concern is goose or poor. Since the capital requirements are comparatively small, there are hardly any financial problems controlling individual enterprise.

The main sources of finance in India may be classified as:-

Nature and scope of capital budgeting:

Meaning of Capital Budgeting:

Capital expenditure budget or capital budgeting is a process of making decisions regarding investments in fixed assets which are not meant for sale such as land, building, machinery or furniture. The word investment refers to the expenditure which is required to be made in connection with the acquisition and the development of long-term facilities including fixed assets.

Nature of Capital Budgeting:

Nature of capital budgeting can be explained in brief as under Capital expenditure plans involve a huge investment in fixed assets. Capital expenditure once approved represents long-term investment that cannot be reserved or withdrawn without sustaining a loss. Preparation of coital budget plans involve forecasting of several years profits in advance in order to judge the profitability of projects. It may be asserted here that decision regarding capital investment should be taken very carefully so that the future plans of the company are not affected adversely.

Payback period:

In this technique, we try to figure out how long it would take to recover the invested capital through positive cash flows of the business.

Reverting back to the café

Example:

An initial investment of Rs. 200,000 is required to start the business;

Rs 10,000 per month are expected to be earned for the first year, and Rs 20,000 would be earned every month in the second year. Now according to the aforementioned assumptions, in the first year, you earn Rs.10, 000 per month, which make Rs. 120,000 for the year (twelve months). Since you had invested Rs. 200,000

Initially of which Rs. 120,000 have been recovered in the first year, you are still Rs.80,000 short of recovering your initial investment. In the second year, you would be earning Rs. 20,000 per month, so the remaining Rs. 80,000 can be recovered in the next four months. We can say that the initial invested capital can be recovered in 16 months, or the payback period for this investment is 16 months. The shorter the payback period of a project, the more an investor would be willing to invest his money in the project.

While the payback period is a simple and straightforward method for analyzing a capital budgeting proposal, it has certain limitations. First and the foremost problem is that it does not take into account the concept of time value of money. The cash flows are considered regardless of the time in which they are occurring. You must have noticed that we have not used any interest rate while making Calculation.

Now, let us talk about the next budgeting criteria called return on investment.

Accounting Rate of Return method:

The Accounting rate of return (ARR) method uses accounting information, as revealed by financial statements, to measure the profit abilities of the investment proposals. The accounting rate of return is found out by dividing the average income after taxes by the average investment.

ARR= Average income/Average Investment

Advantages:

Limitations:

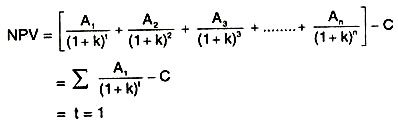

Net Present Value Method (simple problems):

The net present value (NPV) method is a process of calculating the present value of cash flows (inflows and outflows) of an investment proposal, using the cost of capital as the appropriate discounting rate, and finding out the net profit value, by subtracting the present value of cash outflows from the present value of cash inflows.

The equation for the net present value, assuming that all cash outflows are made in the initial year (tg), will be:

Advantages:

Limitations:

The concept of cost of capital is a very important concept in financial management decision making. The concept is however, a recent development and has relevance in almost every financial decision making but prior to that development, the problem was ignored or by-passed.

The progressive management always takes notice of the cost of capital while taking a financial decision. The concept is quite relevant in the following managerial decisions.

Capital Budgeting Decision:

Cost of capital may be used as the measuring road for adopting an investment proposal. The firm, naturally, will choose the project which gives a satisfactory return on investment which would in no case be less than the cost of capital incurred for its financing. In various methods of capital budgeting, cost of capital is the key factor in deciding the project out of various proposals pending before the management. It measures the financial performance and determines the acceptability of all investment opportunities.

Indirect Forecast of Sales:

The investment in fixed assets is related to future sales of the firm during the life time of the assets purchased. It shows the possibility of expanding the production facilities to cover additional sales shown in the sales budget. Any failure to make the sales forecast accurately would result in over investment or under investment in fixed assets and any erroneous forecast of asset needs may lead the firm to serious economic results.

Comparative Study of Alternative Projects:

Capital budgeting makes a comparative study of the alternative projects for the replacement of assets which are wearing out or are in danger of becoming obsolete so as to make the best possible investment in the replacement of assets. For this purpose, the profitability of each project is estimated.

Timing of Assets-Acquisition:

Proper capital budgeting leads to proper timing of assets-acquisition and improvement in quality of assets purchased. It is due to ht nature of demand and supply of capital goods. The demand of capital goods does not arise until sales impinge on productive capacity and such situation occurs only intermittently. On the other hand, supply of capital goods with their availability is one of the functions of capital budgeting.

Cash Forecast:

Capital investment requires substantial funds which can only be arranged by making determined efforts to ensure their availability at the right time. Thus, it facilitates cash forecast.

Worth-Maximization of Shareholders:

The impact of long-term capital investment decisions is far reaching. It protects the interests of the shareholders and of the enterprise because it avoids over-investment and under-investment in fixed assets. By selecting the most profitable projects, the management facilitates the wealth maximization of equity share-holders.

Other Factors:

The following other factors can also be considered for its significance:-

It assists in formulating a sound depreciation and assets replacement policy.

It may be useful n considering methods of coast reduction. A reduction campaign may necessitate the consideration of purchasing most up-to-date and modern equipment.

The feasibility of replacing manual work by machinery may be seen from the capital forecast be comparing the manual cost and the capital cost.

The capital cost of improving working conditions or safety can be obtained through capital expenditure forecasting.

It facilitates the management in making of the long-term plans and assists in the formulation of general policy.

It studies the impact of capital investment on the revenue expenditure of the firm such as depreciation, insure and their fixed assets.

Types of Capital, Estimation of Fixed and Working capital requirements:

Meaning of Working capital:

- Working Capital is the amount of Capital that a Business has available to meet the day-to-day cash requirements of its operations

- Working Capital is the difference between resources in cash or readily convertible into cash (Current Assets) and organizational commitments for which cash will soon be required (Current Liabilities) .It refers to the amount of Current Assets that exceeds Current Liabilities (i.e. CA - CL). Working Capital = Current Assets - Current Liabilities

Gross working capital:

When we say working capital, we are referring to the net working capital. Firm’s investment in current assets is called.

Net working capital:

The different between current assets and current liabilities is called Net working capital can be positive or negative. When current assets are in excess of current liabilities, net working capital is positive. On the other hand, when current liabilities exceed current assets, net working capital is negative.

Gross working capital indicates firm’s investment and financing of current assets. Net working capital, on the other hand, shows the liquidity of a firm. As the result, net working capital indicates the financing needs of a firm, both through long-term and short-term financing sources:

Working capital is the part of firm’s capital that is used for routine day-to-day business operations. In other words, working capital refers to the funds needed by the business to run its operations for one accounting year. Working capital reflects the amount of money a firm has at its immediate disposal. For more information about working capital refer to tutorial Liquidity and working capital analysis.

Adequate working capital is important for any business operations. Working capital financing, however, can be a challenge for a business, especially for a small firm. In order to understand the best way to finance working capital, it is important to understand the difference between the two types of working capital:

- permanent working capital

- temporary working capital

2. Permanent working capital

- Working Capital refers to that part of the firm’s Capital, which is required for Financing Short-Term or Current Assets such as Cash, Marketable Securities, Debtors and Inventories.

When we say working capital, we are referring to the net working capital. Firm’s investment in current assets is called gross working capital. The different between current assets and current liabilities is called net working capital. Net working capital can be positive or negative. When current assets are in excess of current liabilities, net working capital is positive. On the other hand, when current liabilities exceed current assets, net working capital is negative.

Gross working capital indicates firm’s investment and financing of current assets. Net working capital, on the other hand, shows the liquidity of a firm. As the result, net working capital indicates the financing needs of a firm, both through long-term and short-term financing sources.

Working capital is the part of firm’s capital that is used for routine day-to-day business operations. In other words, working capital refers to the funds needed by the business to run its operations for one accounting year. Working capital reflects the amount of money a firm has at its immediate disposal. For more information about working capital refer to tutorial Liquidity and working capital analysis.

Adequate working capital is important for any business operations. Working capital financing, however, can be a challenge for a business, especially for a small firm. In order to understand the best way to finance working capital, it is important to understand the difference between the two types of working capital:

- permanent working capital

- temporary working capital

Essentially, permanent working capital is the minimum level of working capital required for a firm to operate.

Permanent working capital is also called fixed working capital. Permanent working capital does not depend on the level of production or sales. It is similar – in some sense – to fixed assets because of its permanent (fixed) nature. Important to note, however, that permanent working capital is not literally fixed: its level can change over time. The level of permanent working capital depends on the business cycle as well as the growth of a firm.

Permanent working capital can be further divided into the following categories:

- Regular working capital:

Minimum level of working capital required to circulate from one form to another: from cash to inventory, inventory to receivables, receivables to cash, and so on.

- Reserve working capital:

Permanent working capital in excess of regular working capital. Reserve working

capital arises from such contingencies as union strikes, recession, etc. Estimation of Fixed and Working capital requirements:2.

It has been indicated above that a company should be properly capitalized can that the actual capital should be neither more nor less than the amount which is needed and which can be gainfully employed.

It is, therefore, necessary for a new concern to estimate its requirements of funds properly. The financial requirements of a new company may be outlined under the following heads:

- Cost of fixed assets including land and buildings, plant and machinery, furniture, etc. The amount invested in these items is called fixed capital.

- Cost of current assets including cash, stock of goods (also called inventory of merchandise), book debts, bills, etc.

- Cost of promotion including the expenses on preliminary investigation, accounting, marketing and legal advice, etc.

- Cost of setting up the organization.

- Cost of establishing the business, i.e., the operating losses which have generally to be sustained in the initial periods of a company.

- Cost of financing including brokerage on securities, commission on underwriting, etc.

- Cost of intangible assets like goodwill, patents, etc. of the various items of financial requirements listed above, the first two deserve special consideration, as the successes of any concern will depend largely on them.

Methods and sources of raising finance:

The methods of financing should be adjusted to the stage or phase of the trade cycle. The total capital shall be raised by different means, or what is sometimes called “geared”, according to the phase of the cycle.

Different types of securities may be issued in certain proportions, and what ratio each type will bear to the total capital will depend upon the particular phase.

For example, in the beginning of an optimistic expansion, debentures may be offered to good advantage. At a later time, when speculative enthusiasm is strong, shares will yield better returns. During depression short time borrowing can be resorted to, if the credit of the company is good. The financing plan may be adjusted to the conditions of the market and the security market by varying the proportion, rate of yield, term denominations and guaranteed rights of the securities issued.

The sources of finance for an enterprise can be many and diverse. In the case of individualistic concerns, the chief source of finance is the individual proprietor or proprietors as in a partnership or a Joint Hindu family business. This may be supplemented by borrowed money in varying amounts according as the credit of the concern is goose or poor. Since the capital requirements are comparatively small, there are hardly any financial problems controlling individual enterprise.

The main sources of finance in India may be classified as:-

- Individual investment, only in the case of individualistic concerns.

- Issue of shares of different kinds.

- Issue of bonds and debentures.

- Public deposits.

- Managing agents.

- Loans from joint-stock banks and indigenous bankers.

- Gradual development method of using profits to increase capital sometimes called Ploughing back of earnings.

- The State.

Nature and scope of capital budgeting:

Meaning of Capital Budgeting:

Capital expenditure budget or capital budgeting is a process of making decisions regarding investments in fixed assets which are not meant for sale such as land, building, machinery or furniture. The word investment refers to the expenditure which is required to be made in connection with the acquisition and the development of long-term facilities including fixed assets.

Nature of Capital Budgeting:

Nature of capital budgeting can be explained in brief as under Capital expenditure plans involve a huge investment in fixed assets. Capital expenditure once approved represents long-term investment that cannot be reserved or withdrawn without sustaining a loss. Preparation of coital budget plans involve forecasting of several years profits in advance in order to judge the profitability of projects. It may be asserted here that decision regarding capital investment should be taken very carefully so that the future plans of the company are not affected adversely.

Payback period:

In this technique, we try to figure out how long it would take to recover the invested capital through positive cash flows of the business.

Reverting back to the café

Example:

An initial investment of Rs. 200,000 is required to start the business;

Rs 10,000 per month are expected to be earned for the first year, and Rs 20,000 would be earned every month in the second year. Now according to the aforementioned assumptions, in the first year, you earn Rs.10, 000 per month, which make Rs. 120,000 for the year (twelve months). Since you had invested Rs. 200,000

Initially of which Rs. 120,000 have been recovered in the first year, you are still Rs.80,000 short of recovering your initial investment. In the second year, you would be earning Rs. 20,000 per month, so the remaining Rs. 80,000 can be recovered in the next four months. We can say that the initial invested capital can be recovered in 16 months, or the payback period for this investment is 16 months. The shorter the payback period of a project, the more an investor would be willing to invest his money in the project.

While the payback period is a simple and straightforward method for analyzing a capital budgeting proposal, it has certain limitations. First and the foremost problem is that it does not take into account the concept of time value of money. The cash flows are considered regardless of the time in which they are occurring. You must have noticed that we have not used any interest rate while making Calculation.

Now, let us talk about the next budgeting criteria called return on investment.

Accounting Rate of Return method:

The Accounting rate of return (ARR) method uses accounting information, as revealed by financial statements, to measure the profit abilities of the investment proposals. The accounting rate of return is found out by dividing the average income after taxes by the average investment.

ARR= Average income/Average Investment

Advantages:

- It is very simple to understand and use.

- It can be readily calculated using the accounting data.

- It uses the entire stream of incomes in calculating the accounting rate.

Limitations:

- It uses accounting, profits, not cash flows in appraising the projects.

- It ignores the time value of money; profits occurring in different periods are valued equally.

- It does not consider the lengths of projects lives.

- It does not allow for the fact that the profit can be reinvested.

Net Present Value Method (simple problems):

The net present value (NPV) method is a process of calculating the present value of cash flows (inflows and outflows) of an investment proposal, using the cost of capital as the appropriate discounting rate, and finding out the net profit value, by subtracting the present value of cash outflows from the present value of cash inflows.

The equation for the net present value, assuming that all cash outflows are made in the initial year (tg), will be:

Advantages:

- It recognizes the time value of money

- It considers all cash flows over the entire life of the project in its calculations.

- It is consistent with the objective of maximizing the welfare of the owners.

Limitations:

- It is difficult to use

- It presupposes that the discount rate which is usually the firm’s cost of capital is known. But in practice, to understand cost of capital is quite a difficult concept.

- It may not give satisfactory answer when the projects being compared involve different amounts of investment.

Published date : 19 Aug 2015 02:50PM