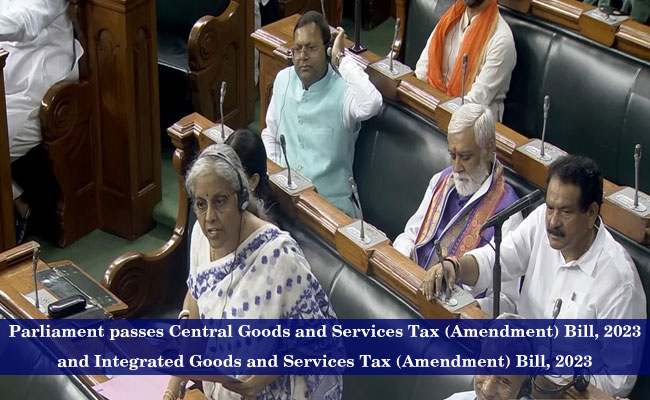

Parliament passes Central Goods and Services Tax (Amendment) Bill, 2023 and Integrated Goods and Services Tax (Amendment) Bill, 2023

Sakshi Education

- Parliament today passed the Central Goods and Services Tax (Amendment) Bill, 2023 and Integrated Goods and Services Tax (Amendment) Bill, 2023.

- The Lok Sabha passed the bills without discussion with voice vote. Later, the Rajya Sabha also returned the Bills with voice vote. Finance Minister Nirmala Sitharaman introduced these bills.

- The Central Goods and Services Tax (Amendment) Bill, 2023 seeks to amend the Central Goods and Services Tax Act 2017 while, the Integrated Goods and Services Tax (Amendment) Bill, 2023 seeks to amend the Integrated Goods and Services Tax Act 2017.

- The Central Goods and Services Tax (Amendment) Bill, 2023 seeks to define the expressions of online gaming, online money gaming and virtual digital assets. According to the provisions of the Bill, online gaming means offering of a game on the internet or an electronic network and includes money gaming. The Bill states that online money gaming means online gaming in which players pay or deposit money including virtual digital assets in expectation of winning money.

- The Integrated Goods and Services Tax (Amendment) Bill, 2023 seeks to amend the Integrated Goods and Services Tax Act 2017 to exclude online money gaming from the definition of online information and data access or retrieval services. The GST Council in its 50th meeting held last month, recommended to levy 28 percent tax on full face value of bets in Casinos, Horse racing and Online gaming.

>> Download Current Affairs PDFs Here

Download Sakshi Education Mobile APP

Published date : 12 Aug 2023 11:47AM