Union Budget 2024-25 Highlights!

Union Budget 2024-25: Highlights

FM Nirmala Sitaraman has presented the budget 2024. She said that the country's inflation rate is at 3.1% and fiscal deficit is estimated at 4.9% of GDP. Here are the highlights -

This year's budget theme focuses on four key factors: employment, skilling, MSMEs, and the middle class, says Sitharaman.

Agriculture

- Increased the minimum support price for farmers.

- Providing free rations to 800 million people for five years.

- Increasing productivity and achieving self-sufficiency in agriculture

- Digital Crop Survey for Kharif crops.

- An allocation of ₹1.52 lakh crore has been made for agriculture and allied sectors.

- Adapting to climate change with 9 types of measures

New Tax Slab:

- 0% tax upto Rs. 3lakh income.

- Rs 3-7 Lakh income: 5% tax

- Rs. 7-10 Lakh: 10%

- Rs. 10-12 lakh: 15%

- Rs. 12-15 lakh: 20%

- Rs. 15 Lakh above: 30%

NPS Vatsalya Scheme in Budget 2024:

- Investment for Children: Parents can invest in the NPS Vatsalya scheme for their child.

- Account Transfer: Once the child becomes an adult, the account can be transferred to them.

Taxes:

- Exemption of capital gains increased to Rs 1.25 lakh per year for certain assets.

- Removal of taxes on medications for cancer patients.

- An assessment can be reopened after three years only if escaped income is Rs 50 crore or more.

- Comprehensive review of Income-tax Act, 1961.

- Standard Deduction increased from Current Limit: ₹50,000 to ₹75,000.

- NPS contribution limit for employer in private sector raised from 10% to 14% of the employee’s basic salary

- Deduction on family pension for pensioners increased from ₹15,000 to ₹25,000

- Provide for safe harbour rates for foreign mining companies (Selling raw diamonds)

- Corporate tax rate on foreign companies reduced from 40% to 35%

FDI Simplification and Promotion:

- Simplification: Rules and recognition for Foreign Direct Investments (FDIs) will be simplified to facilitate their inflow.

- Rupee Promotion: The move aims to prioritize and promote the use of the Rupee for overseas investments.

Industries:

- Job Creation: Scheme for providing internship opportunities in 500 top companies to 1 crore youth in 5 years.

- Allowance of ₹5,000 per month along with a one-time assistance of ₹6,000 through the CSR funds.

- Industrial Parks: Establishment of plug-and-play industrial parks in 100 cities.

- Development Centers: Setting up 12 comprehensive industrial development centers.

- Affordable Housing: Construction of rental housing for workers in industrial areas.

- Dormitory-Style Housing: Development of dormitory-style housing under the PPP model.

- Introduction of a new scheme to facilitate term loans for MSMEs for purchasing machinery and equipment.

- Collateral: Loans will be provided without collateral and guarantee.

- Guarantee Fund: The scheme will include a guarantee fund providing guarantees of up to ₹100 crore.

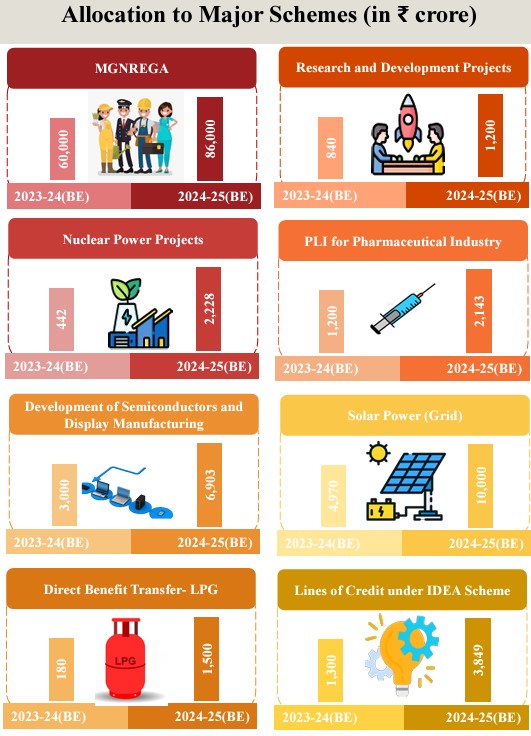

- Support private-driven research at a commercial scale with ₹1 lakh crore.

Tourism:

- Temple Corridors:

- Development of corridors at Vishnupad Temple and Mahabodhi Temple, modeled after the Kashi Vishwanath Temple.

- Tourism Development:

- Support for the development of Nalanda in Bihar as a tourist center.

- Assistance to Odisha for tourism development.

- Economic Policy Framework:

- Introduction of an economic policy framework to usher in next-generation reforms aimed at boosting economic growth.

- Comprehensive development initiative for Rajgir will be undertaken which holds religious significance for Hindus, Buddhists and Jains.

Small and modular nuclear reactors in focus

The government will partner with the private sector to:

- Set up Bharat small reactors.

- Research and develop Bharat small modular reactors.

- Research and develop new technologies for nuclear energy.

Flood Management and Assistance:

- Bihar: Acknowledged frequent flood issues and ongoing delays in building flood control structures in Nepal. Financial support of ₹11,500 crore will be provided.

- Assam: Will receive assistance for flood management and related projects due to annual flooding.

- Himachal Pradesh: Support for reconstruction through multilateral assistance following extensive flood-related losses.

- Uttarakhand: Provision of necessary assistance for damage caused by landslides and cloudbursts.

Focus on Energy Security:

- Policy Document: A policy document on energy transition pathways will be released, emphasizing employment and sustainability.

- PM Surya Ghar Muft Bijli Yojana:

- Launch of rooftop solar plants providing free electricity up to 300 units per month to 1 crore households.

- The initiative has received 1.28 crore registrations and 14 lakh applications, marking a significant achievement.

Space

- Aim to expand the space economy by five times over the next 10 years.

- Support Fund: Establishment of a venture capital fund of ₹1,000 crore to support this goal.

Customs Duty Reduction:

- Basic Customs Duty (BCD) on mobile phones, mobile Printed Circuit Design Assembly (PCDA), and mobile chargers will be reduced to 15%.

- Proposal to increase the duty on printed circuit board assemblies (PCBA) for specific telecom equipment by 10 to 15%.

- Customs duty on gold and silver to be reduced to 6%, platinum to 6.4%

- Customs duty to be increased on plastics.

- Customs duty reduced on more than 25 minerals.

- Reduce BCD on shrimp and fish feed to 5%

- Exempted more capital goods for manufacturing of solar cells & panels

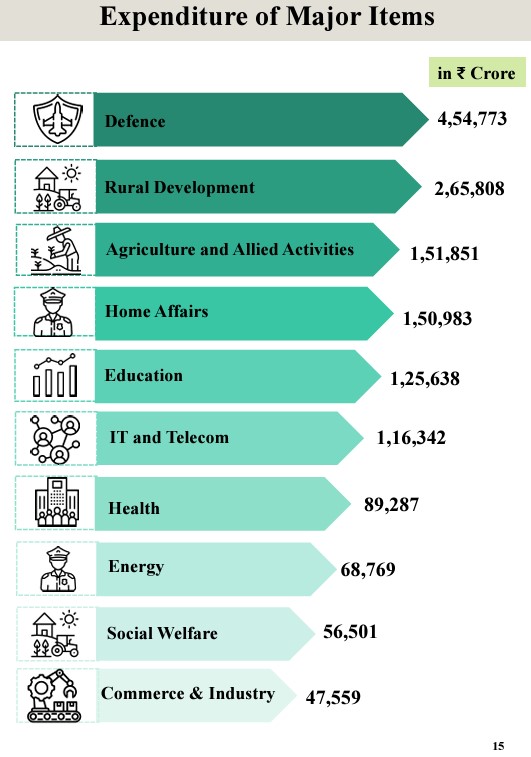

Infrastructure

- 15,000 crore for Amaravati development

- Support for Polavaram project

- Funds allocated under a special package for Rayalaseema, Prakasam, and North Andhra districts.

- Efforts made to fulfill commitments outlined in the Andhra Pradesh Reorganisation Act.

- Visakhapatnam-Chennai Corridor: Funds allocated for Kopparti.

- Hyderabad-Bengaluru Corridor: Funds allocated for Orvakallu.

- The central government will provide financial assistance to Bihar through funds from multi-agency development programs.

- Support for the Amritsar-Kolkata Industrial Corridor

- Development of an industrial node at Gaya in Bihar to boost the eastern region.

- Construction of new airports, medical colleges, and sports infrastructure in Bihar.

- Expedited processing of Bihar government's requests for external assistance from multilateral development banks.

- Setting up a new 2,400 MW power plant at Pirpainti, with a total cost: ₹21,400 crores.

- Support for road connectivity projects:

- Patna-Purnea Expressway

- Buxar-Bhagalpur Highway

- Bodhgaya-Rajgir-Vaishali-Darbhanga route

- Additional two-lane bridge over the Ganga River in Buxar

- Total Allocation: ₹26,000 crores.

- ₹2.2 lakh crore push to make housing more affordable.

Fiscal Support for Infrastructure:

- Capital Expenditure: ₹11.11 lakh crore allocated for capital expenditure this year.

- GDP Proportion: This allocation amounts to 3.4% of India's GDP.

Urban Development

- Stamp Duty Reduction: States charging high stamp duty will be encouraged to moderate their rates for all.

- Additional Reductions: Further reductions in duties for properties purchased by women will be considered.

- Under PM Awas Yojana, Urban 2.0, the housing needs of the urban poor and middle class will be addressed with an investment of ₹10 lakh crore.

Job Creation in the Manufacturing Sector:

- The finance minister introduced a scheme to boost job creation in the manufacturing sector by linking it to the employment of first-time workers.

- Offers incentives for EPFO contributions to both employees and employers for the first four years of employment.

- Expected to benefit 3 million young people and cover additional employment across all sectors.

- Employers will be reimbursed up to ₹3,000 per month for two years for each additional employee's EPFO contributions.

- The initiative aims to incentivize the employment of 5 million additional people.

Rural Development

- Rs 2.66 lakh crore for rural development

- The limit for MUDRA loans will be increased to ₹20 lakh from the current ₹10 lakh for individuals who have availed and successfully repaid loans under the TARUN category.

- Pradhan Mantri Janjatiya Unnat Gram Abhiyan: Improving the socio-economic condition of tribal communities covering 63,000 villages benefitting 5 crore tribal people.

- More than 100 branches of India Post Payment Bank will be set up in the Northeast region.

Youth:

- A new centrally sponsored scheme to skill 20 lakh youth over 5 years.

- Upgrading around 1,000 ITIs with a hub-and-spoke arrangement.

- Course content will be tailored to the needs of the industry, focusing on emerging sectors.

- One month's wage to be provided to all individuals newly entering the workplace in all formal sectors.

- Direct Benefit Transfer of one month's salary, up to ₹15,000, to be given in 3 installments to first-time employees registered in the EPFO.

- Eligibility limit for the benefit is a salary of ₹1 lakh per month.

- The scheme is expected to benefit 2.1 lakh youth.

- Loans up to ₹7.5 lakh with a guarantee from a government promoted Fund.

- Financial support for loans upto ₹10 lakh for higher education in domestic institutions.

- Direct E-vouchers to 1 lakh students every year. - Annual interest subvention of 3%

Women:

- Increasing women's participation in the workforce will be a priority.

- Establishing hostels and forming partnerships to organize women-specific skilling programs.

- Allocation of more than ₹3 lakh crore for schemes benefitting women and girls.

- Facilitate higher participation of women in the workforce through setting up of working women hostels in collaboration with industry and establishing creches.

Employees:

- Employment-linked skilling schemes announced as part of the PM's package.

- The Finance Minister announced a PM Package of five schemes aimed at facilitating employment and skilling, with an allocation of ₹2 lakh crore.

- A provision of ₹1.48 lakh crore has been made for education, employment, and skilling this year.

- Schemes based on enrolment in the EPFO, focusing on first-time employees.

- First-time employees to receive one month's wage upon entering the workforce in formal sectors.

- Direct Benefit Transfer (DBT) of one month's salary, up to ₹15,000, provided in three installments.

- Eligibility limit for this benefit is a salary of ₹1 lakh per month.

- Expected to benefit 2.1 lakh youths.

Following the goals set in the Interim Budget, we have established nine priorities:

- Productivity and resilience in agriculture

- Employment and skilling

- Inclusive human resource development and social justice

- Manufacturing and services

- Urban development

- Energy security

- Infrastructure

- Innovation and research and development

- Next-generation reforms

Earlier, Union Finance Minister Nirmala Sitharaman presented the Economic Survey for the financial year 2023-24 in the Lok Sabha.

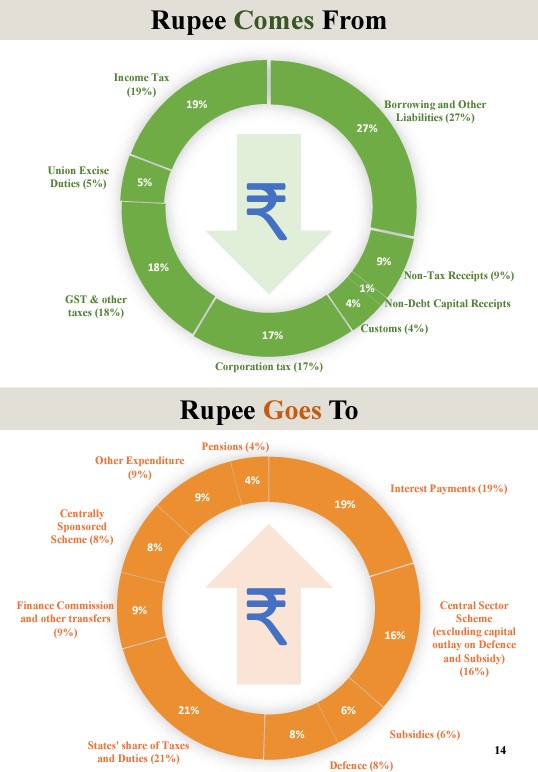

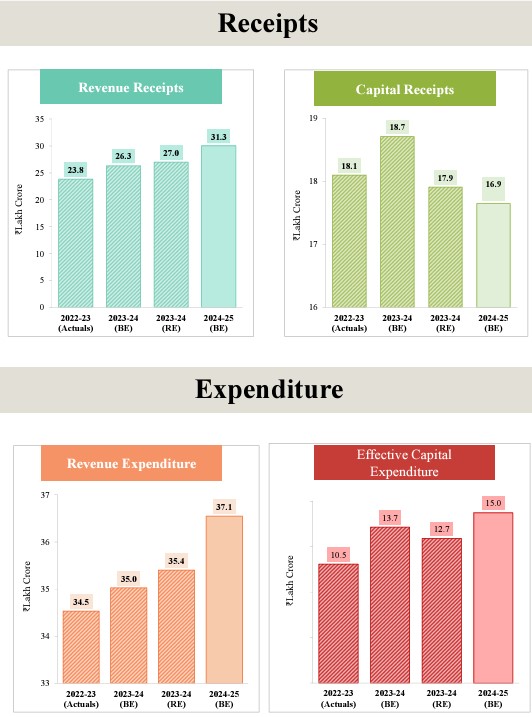

Budget at a Glance (In ₹ Crore)

| Particulars | 2022-2023 Actuals | 2023-2024 Budget Estimates | 2023-2024 Revised Estimates | 2023-2024 Provisional Actuals | 2024-2025 Budget Estimates |

|---|---|---|---|---|---|

| 1. Revenue Receipts | 2,383,206 | 2,632,281 | 2,699,713 | 2,728,412 | 3,129,200 |

| 2. Tax Revenue (Net to Centre) | 2,097,786 | 2,330,631 | 2,323,918 | 2,326,524 | 2,583,499 |

| 3. Non-Tax Revenue | 285,421 | 301,650 | 375,795 | 401,888 | 545,701 |

| 4. Capital Receipts | 1,809,951 | 1,870,816 | 1,790,773 | 1,714,130 | 1,691,312 |

| 5. Recovery of Loans | 26,161 | 23,000 | 26,000 | 27,338 | 28,000 |

| 6. Other Receipts | 46,035 | 61,000 | 30,000 | 33,122 | 50,000 |

| 7. Borrowings and Other Liabilities | 1,737,755 | 1,786,816 | 1,734,773 | 1,653,670 | 1,613,312 |

| 8. Total Receipts (1+4) | 4,193,157 | 4,503,097 | 4,490,486 | 4,442,542 | 4,820,512 |

| 9. Total Expenditure (10+13) | 4,193,157 | 4,503,097 | 4,490,486 | 4,442,542 | 4,820,512 |

| 10. On Revenue Account (of which) | 3,453,132 | 3,502,136 | 3,540,239 | 3,494,036 | 3,709,401 |

| 11. Interest Payments | 928,517 | 1,079,971 | 1,055,427 | 1,063,871 | 1,162,940 |

| 12. Grants in Aid for Creation of Capital Assets | 306,264 | 369,988 | 321,190 | 303,787 | 390,778 |

| 13. On Capital Account | 740,025 | 1,000,961 | 950,246 | 948,506 | 1,111,111 |

| 14. Effective Capital Expenditure (12+13) | 1,046,289 | 1,370,949 | 1,271,436 | 1,252,293 | 1,501,889 |

| 15. Revenue Deficit (10-1) | 1,069,926 | 869,855 | 840,527 | 765,624 | 580,201 |

| 16. Effective Revenue Deficit (15-12) | 763,662 | 499,867 | 519,337 | 461,837 | 189,423 |

| 17. Fiscal Deficit [9-(1+5+6)] | 1,737,755 | 1,786,816 | 1,734,773 | 1,653,670 | 1,613,312 |

| 18. Primary Deficit (17-11) | 809,238 | 706,845 | 679,346 | 589,799 | 450,372 |

Key Highlights of the Economic Survey 2023-24:

Global economic growth was 3.2 per cent in 2023, with divergent growth patterns due to domestic issues, geopolitical conflicts, and monetary policy tightening. Despite external challenges, India's real GDP grew by 8.2 per cent in FY24, driven by strong capital expenditure and private investment.

- Capital Formation: Gross Fixed Capital Formation increased by 9 per cent in real terms in 2023-24.

- Inflation: Retail inflation declined to 5.4 per cent in FY24, from 6.7 per cent in FY23.

- Fiscal Balance: Improved due to tax compliance gains, expenditure restraint, and digitisation.

- External Balance: Current Account Deficit improved to 0.7 per cent of GDP in FY24, from 2.0 per cent in FY23, aided by strong services exports.

- Banking Sector: Showcased strong performance with broad-based credit growth and low NPAs.

- Stock Market: Significant surge in market capitalization, making India’s ratio to GDP the fifth largest globally.

- Financial Inclusion: Focus on digital payments and direct benefit transfers.

- Short-Term Outlook: Inflation projected to fall to 4.5% in FY25 and 4.1% in FY26.

- Long-Term Outlook: Emphasis on modern storage, price monitoring, and increasing domestic production of essential food items.

- External Sector: Strong despite global headwinds, with improved export diversification and services exports.