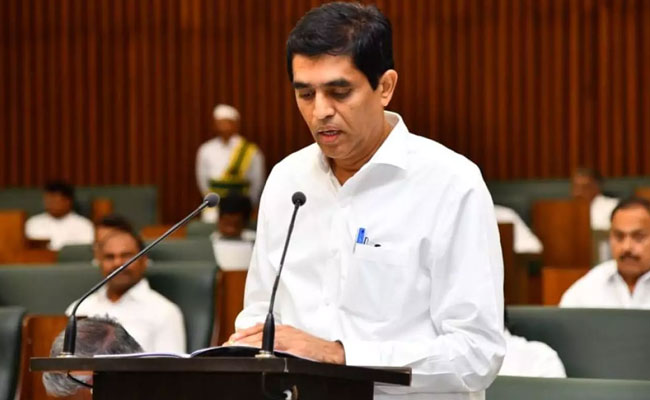

AP BUDGET 2022-23

The Finance Minister of Andhra Pradesh, Mr. BugganaRajendranath, presented the Budget for the state for the financial year 2022-23 on March 11, 2022.

- The Gross State Domestic Product (GSDP) of Andhra Pradesh for 2022-23 (at current prices) is projected to be Rs 13,38,575 crore. This is a growth of 11% over the revised estimates of GSDP for 2021-22 (Rs 12,01,736 crore). In 2021-22, GSDP is estimated to grow at 18% over the previous year (at current prices).

- Expenditure (excluding debt repayment) in 2022-23 is estimated to be Rs 2,39,986 crore, a 24% increase over the revised estimates of 2021-22 (Rs 1,93,548 crore). In addition, debt of Rs 16,270 crore will be repaid by the state in 2022-23. In 2021-22, expenditure (excluding debt repayment) is estimated to be 10% lower than the budget estimate.

- Receipts (excluding borrowings) for 2022-23 are estimated to be Rs 1,91,262 crore, an increase of 23% over the revised estimates of 2021-22 (Rs 1,55,324 crore). In 2021-22, receipts (excluding borrowings) are estimated to fall short of the budget estimate by Rs 21,923 crore (a decrease of 12%).

- Fiscal deficit for 2022-23 is targeted at Rs 48,724 crore (3.64% of GSDP). In 2021-22, as per the revised estimates, the fiscal deficit is expected to be 3.18% of GSDP, lower than the budget estimate of 3.49% of GSDP.

- Revenue deficit for 2022-23 is estimated to be Rs 17,036 crore, which is 1.27% of the GSDP. In 2021-22, the state is estimated to observe a revenue deficit of 1.63% of GSDP, as compared to a revenue deficit of 0.47% of GSDP, at the budget estimates stage.

Policy Highlights

Agriculture and allied activities: To address the problem of spurious seeds, fertilisers, and pesticides, 77 Agri Testing labs will be operationalised from Kharif 2022. The cost of installing electricity meters for agricultural pump sets will be borne by the state government. Further, Mobile Veterinary Ambulatory Clinics will be operationalised by purchasing 340 ambulances.

Education: In phase III of the Nadu-Nedu program, infrastructure in 24,620 schools will be upgraded. Under this program infrastructure facilities (such as furniture, fans, lights, and drinking water) in schools are upgraded.

Special Development Package: To implement development programs at the constituency level, in line with local needs and preferences, a Special Development Package Fund is being established. Every Member of Legislative Assembly will have two crore rupees at their disposal to implement development programs.

Budget Estimates for 2022-23

- Expenditure (excluding debt repayment) in 2022-23 is targeted at Rs 2,39,986 crore. This is an increase of 24% over the revised estimate of 2021-22 (Rs 1,93,548 crore). This expenditure is proposed to be met through receipts (excluding borrowings) of Rs 1,91,262 crore and net borrowings of Rs 48,546 crore. Receipts (excluding borrowings) for 2022-23 are expected to register an increase of 23% over the revised estimate of 2021-22. In 2021-22, receipts are estimated to be 12% lower than the budget estimates.

- In 2022-23, the state is estimated to observe a revenue deficit of Rs 17,036 crore, which is 1.27% of its GSDP. In comparison, in 2020-21 and 2021-22, the state observed a revenue deficit of 3.6% of GSDP (Rs 35,540 crore) and 1.63% of GSDP (Rs 19,545 crore), respectively.

- Fiscal deficit in 2022-23 is estimated to be 3.64% of GSDP which is within the limit of 4% of GSDP permitted by the central government in Union Budget 2022-23 (of which, 0.5% of GSDP will be made available upon undertaking power sector reforms). In 2021-22, the state has estimated a fiscal deficit of 3.18% of GSDP, which is lower than the limit of 4.5% of GSDP permitted by the central government (of which, 0.5% of GSDP becomes available upon undertaking power sector reforms)

- Committed expenditure: Committed expenditure of a state typically includes expenditure on payment of salaries, pensions, and interest. A larger proportion of the budget allocated for committed expenditure items limits the state’s flexibility to decide on other expenditure priorities such as developmental schemes and capital outlay. In 2022-23, Andhra Pradesh is estimated to spend Rs 38,607 crore on committed expenditure items, which is 20% of its revenue receipts. This comprises spending on interest payments (11%) and pension (9%). Note that this figure does not include the expenditure on salaries (which is not available). Committed expenditure (exclusive of salaries) in 2022-23 is estimated to increase by 11% over the revised estimate of 2021-22. Interest payments are estimated to decrease by 3%, whereas pension payments are estimated to increase by 34%.

Receipts in 2022-23

- Total revenue receipts for 2022-23 are estimated to be Rs 1,91,225 crore, an increase of 24% over the revised estimate of 2021-22. Of this, Rs 1,02,143 crore (53%) will be raised by the state through its own resources, and Rs 89,083 crore (47%) will come from the centre. Resources from the centre will be in the form of state’s share in central taxes (17% of revenue receipts) and grants (29% of revenue receipts).

- Devolution: In 2022-23, the state estimates to receive Rs 33,050 crore in the form of share in central taxes, an increase of 28% over the revised estimates of 2021-22.

- State’s own tax revenue: Total own tax revenue of Andhra Pradesh is estimated to be Rs 91,050 crore in 2022-23, an increase of 24% over the revised estimate of 2021-22. Andhra Pradesh’s own tax revenue as a percentage of GSDP is estimated to rise from 5.7% of GSDP in 2020-21 (as per actuals) to 6.8% of GSDP in 2022-23 (as per budget estimate). In 2021-22, while GSDP estimate has been revised down by 14%, no change is estimated in state’s own tax revenue or any of its components as presented in Table 6 (leading to own tax to GSDP ratio rising from 4.6% at the budget stage to 5.2% at the revised stage).

- State’s non-tax revenue: In 2022-23, the state is estimated to earn Rs 11,093 crore in the form of state’s own non-tax revenue, a 103% increase over the revised estimates of 2021-22. In 2021-22, state’s own non-tax revenue is estimated to register a decrease of 23% over the previous year.

Deficits and Debt Targets for 2022-23

The Andhra Pradesh Fiscal Responsibility and Budget Management (FRBM) Act, 2006 provides annual targets to progressively reduce the outstanding liabilities, revenue deficit, and fiscal deficit of the state government.

- Revenue Balance: It is the difference between revenue expenditure and revenue receipts. A revenue deficit implies that the government needs to borrow to finance its expenses which do not increase its assets or reduce its liabilities. In 2022-23, Andhra Pradesh is estimated to observe a revenue deficit of Rs 17,036 crore, which is 1.27% of the GSDP. In comparison, in 2020-21 and 2021-22, the state is to observe a revenue deficit of 3.60% of GSDP (Rs 35,540 crore) and 1.63% of GSDP (Rs 19,545 crore), respectively.

- Fiscal deficit: It is the excess of total expenditure over total receipts. This gap is filled by borrowings by the government and leads to an increase in total liabilities of the state government. In 2022-23, the fiscal deficit is estimated to be Rs 48,724 crore (3.64% of GSDP). It is within the limit of 4% of GSDP permitted by the central government in 2022-23 as per the Union Budget (of which, 0.5% of GSDP will be made available upon undertaking power sector reforms).

- As per the revised estimates, in 2021-22, the fiscal deficit of the state is expected to be 3.18 % of GSDP, which is lower than the budget estimate of 3.49% of GSDP. This is lower than the 4.5% limit permitted by the central government for 2021-22 (of which, 0.5% of GSDP becomes available upon undertaking power sector reforms).

- Outstanding liabilities: Outstanding liabilities is the accumulation of total borrowings at the end of a financial year. It also includes any liabilities on public account. At the end of March 2023, the outstanding liabilities of the state are estimated to be 32.79% of the GSDP.

Andhra Pradesh’s expenditure on six key sectors as a proportion of its total expenditure on all sectors. The average for a sector indicates the average expenditure in that sector by 30 states (including Andhra Pradesh) as per their budget estimates of 2021-22.

- Education: Andhra Pradesh has allocated 12.7% of its total expenditure for education in 2022-23. This is lower than the average allocation (15.2%) for education by all states (as per 2021-22 Budget Estimates).

- Health: Andhra Pradesh has allocated 6.6% of its total expenditure on health, which is higher than the average allocation for health by states (6%).\

- Agriculture: The state has allocated 5.7% of its total expenditure towards agriculture and allied activities. This is lower than the average allocation for agriculture by states (6.2%).

- Rural development: Andhra Pradesh has allocated 6.7% of its expenditure on rural development. This is higher than the average allocation for rural development by states (5.7%).

- Police: Andhra Pradesh has allocated 2.9% of its total expenditure on police, which is lower than the average expenditure on police by states (4.3%).

- Roads and bridges: Andhra Pradesh has allocated 1.9% of its total expenditure on roads and bridges, which is significantly lower than the average allocation by states (4.7%).